On Investing and the 2005 Economy

Study of various analyses on the American and global economy lead one to think that a near term global recession is likely. This implies investors should be out of the stock and bond markets for the next year or two, putting funds into either a money market or very short term treasuries. Some funds (perhaps 20 percent) might go into gold equities to capitalize on an expected near term fall in the dollar. After the global recession bottoms out, investors should not reinvest in US equities but rather buy Asian equities (excluding Japan), for that region seems to be where real future growth will occur.

The relevant factors: (1) The US has accumulated severe private debt as well as moderate government debt; (2) as a result the dollar is vulnerable on the international exchange; (3) that’s because the collective private and public deficits have led to impressive foreign holdings of US financial assets, making the dollar vulnerable if foreign investors abandon it; (4) for years business has invested in high tech industries and not in the manufacturing industries that hire average workers (thus there are inadequate jobs for the large blue collar work force); (5) foreign labor is both cheap and now highly skilled, so even US high tech jobs are at risk; (6) the “baby boom” demographics of aging will be detrimental to future US growth.

A major consideration behind these comments concerns risk avoidance. Specifically, avoiding a major loss at the risk of foregoing a marginal gain is intelligent risk aversion tactic (discussed further below).

Rational

Americans have collectively borrowed from overseas sources to make up for the government deficits and inadequate private savings of recent years. In 1982 Americans saved about 11 percent of their income. Since then that savings rate has gradually fallen to under 3 percent now. Private sector debt has risen from 95 percent of GDP in 1970 to 240 percent in 2004. In the same period the government debt has changed from 38 percent to 62 percent of GDP.

In short, the nation is saving a lot less than it used to. The US has been consuming, instead of saving for productive investment. Consumers have borrowed on the equity of their homes to maintain spending levels and thereby made GDP gains possible.

When national savings fall short of national expenditures, we borrow the difference from overseas. And overseas investors have the dollars to loan us because we run trade deficits – we import more than we export. That means dollars accumulate overseas (especially in major US purchasing areas: Japan, China, and Europe). What happens to these overseas held dollars? Some are loaned back to the US to cover deficits. Some are used to buy US assets. And some are held in reserve by foreign banks.

If these foreign held dollar reserves are sold on the currency markets (due to concern over the dollar resulting from large US debts and lowered productivity) then the dollar will indeed fall. And a falling dollar leads to further dollar sales. Then US assets (stocks and bonds) lose value and holding them becomes costly. Thus the argument to get rid of them now.

Also, if the dollar falls, interest rates will need to rise in order to slow the dollar’s fall and still obtain new loans from overseas. After all, the nation’s deficit spending still needs to be covered.

The higher interest rates will make the large cumulative debts – especially those in housing - dangerous. As housing prices have risen, investors have borrowed to speculate on new housing. Further, home buyers have used the increased value of their houses as collateral to borrow funds to consume more, and to speculate further on housing and other real estate investments (eg, Florida condos).

The loans will remain fixed while the speculative “housing bubble” bursts, home values fall, and mortgage payments rise as variable interest rates rise (a large fraction of recent purchases were made with imaginative financing meant to reduce up front payments). Speculators will not be able to make the now higher payments. New loans to pay existing payments will demand even higher rates. As housing prices fall, speculators who had counted on paying off loans by selling their houses before the mortgage payments came due will find they cannot pay them nor afford to refinance them. Meanwhile housing prices fall further yet.

Additionally, US stocks are currently quite highly valued. The S&P 500 index has stocks selling at over 40 times earnings, a very high figure historically. Thus, stocks are likely to fall anyway, but when viewed in the light of a housing bubble, may well collapse as investors sell them to cover their housing mortgages.

A severe recession or depression can result from the combined fall in the dollar, a stock market decline, and the housing bubble bust. And when the US has a major recession the world suffers … for we import much from other economies. Thus a global recession.

Since this global recession may happen in the near future, it seems a good time to be highly liquid. That will leave cash ready to invest in the next global growth phase after the anticipated recession.

Where to invest when growth returns

The US is no longer the area of most potential future growth. It no longer leads in manufacturing. Instead it has overspent in high tech industries that hire few average skill workers. With modern communications, even high tech jobs are outsourced to lower wage countries such as India and Ireland.

Further, the US population is aging. That means more US funds will be spent on Social Security and Medicare instead of on investment in productivity enhancing production.

Some baby boomers have already begun retiring, and retired people spend less, especially if they have saved little. That upcoming drop in consumption will further reduce US growth. Japan’s and Europe’s population are aging even sooner than the US’s, making them undesirable investment alternatives.

It is noteworthy that Japan’s falling stock market era started in 1990 and has now lasted for 15 years. Japan was the apple of the investors eye before 1990. The point is that great economies can suffer for long periods. Further, the US baby boom lags Japan by 10 years, so baby boom dynamics would dictate that the US financial problems became suspect starting in 2000. That indeed is when the US stock market fell heavily, and it has not recovered nor might it for the next ten years if we accept Japan for our model.

The next phase of economic growth will likely occur in East Asia and India. Once the global recession passes East Asia seems to be the area to invest in. They are poised for manufacturing growth such as occurred in the USA, Germany, and Japan in the past. China’s growth is certainly well known.

There is an exception to remaining out of stocks totally. If the dollar is to fall, then putting some funds into gold would be appropriate as gold usually rises if the dollar falls. This can be done by obtaining a gold “exchange traded fund” (or ETF). One such ETF has the market symbol “IAU”, which is traded just like a corporate stock.

Recent history of the stock market

There are empirical stock market dynamics since 1929 relevant to our discussion of a bearish future for the US market. Specifically, the market was bearish from 1929 to 1946 (17 years). It was bullish from 1946 to 1965 (19 years), bearish from 1965 to 1982 (17 years), bullish from 1982 to 2000 (18 years). It would be consistent with this pattern for US stocks to be bearish for 17(?) years from 2000 on. That would reinforce the argument to avoid US equities which have only been bearish for 5 years since 2000.

Implications:

Put most funds into money markets or short term treasury notes until the predicted global recession passes, then invest to take advantage of East Asian growth for a decade or so. If desired, invest in gold for the near term to take advantage of the falling dollar.

When the time comes, there are ETF’s for Asian investments. And with the strong growth in China and India, investment in commodities (energy, food, raw materials) would then be appropriate. But such investment decisions do not need to be made until the global recession eases.

Risk Aversion

The above recommendations are bolstered by a risk-adverse logic. Suppose the US economy does not experience a near term recession. Applying the above recommendations then would mean one forgoes possible gains in the US stock market. One might forgo, say, a 15 percent gain when getting out of stocks for an expected recession that does not happen. 15 percent is not a major sacrifice. But, on the other hand, if one stays with stocks while a major recession occurs, a loss of 50 percent (or more) of a portfolio’s value could occur before counteraction can be taken. That would be a major setback for most people.

Suppose, to make the point, that even a 100 percent gain was foregone by putting the funds in a money market to counter the potential 50 percent loss. For many of us a loss of 50 percent of our portfolio is not acceptable, even if what is given up is a 50-50 chance of a doubling of the funds. Depending on our situation, a doubling of funds is not as beneficial as halving them is detrimental. A retiree, for example may not be able to withstand a halving of assets, no matter how large the potential gain foregone.

So for many of us, the housing bubble, the deficits, the migration of jobs to Asia, are real enough indicators of a recession to argue for the safer road of accepting money market returns for the next year or two…maintaining the flexibility to jump in with both feet once the recession, or its threat, has passed.

Rolf Clark

July 2005

This is the blog of a modern day Cartographer thrown into the business world. Over the course of my journeyman's career I have wandered through positions in government, news agencies, consulting corporations and rogue start ups. The hard-earned working theory I have developed is simple. In life, communication is hard work. In business, effective communication is critical. Hence, this blog parallels the location Intelligence practices on www.GeoSteppes.com.

Esri News Feed

Tuesday, July 26, 2005

Thursday, July 14, 2005

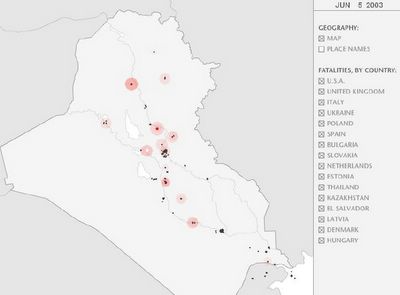

Iraq War Fatalities Animated Map

Iraq War Fatalities

First reported by Nora Parker, Senior Managing Editor, DirectionsMag.com

Graphic designer Tim Klimowitz created this animated map (you'll first see a red button, and then the animation begins) of Iraq showing US and coalition military fatalities per day during the war. Klimowitz says that he was trying to create "something as objective and apolitical" as possible. My nine year old daughter happened to wander into my office while I was looking at the site, and based on her reaction, it was quickly apparent that the map communicates information in a way that could be quickly grasped by almost any audience. According to Klimowitz's description on the site:

"The animation runs at ten frames per second -- one frame for each day -- and a single black dot indicates the geographic location that a coalition military fatality occurred. Each dot starts as a white flash and a large red dot which fades to black over the span of 30 frames/days, and then slowly fades to gray over the span of the entire war."Accompanying the visual representation is a soft 'tic' sound for each fatality, the volume of which increases relative to the number of fatalities that occurred simultaneously that day. More deaths in a smaller area produce visually deeper reds and audibly more pronounced 'tics.'"

First reported by Nora Parker, Senior Managing Editor, DirectionsMag.com

Graphic designer Tim Klimowitz created this animated map (you'll first see a red button, and then the animation begins) of Iraq showing US and coalition military fatalities per day during the war. Klimowitz says that he was trying to create "something as objective and apolitical" as possible. My nine year old daughter happened to wander into my office while I was looking at the site, and based on her reaction, it was quickly apparent that the map communicates information in a way that could be quickly grasped by almost any audience. According to Klimowitz's description on the site:

"The animation runs at ten frames per second -- one frame for each day -- and a single black dot indicates the geographic location that a coalition military fatality occurred. Each dot starts as a white flash and a large red dot which fades to black over the span of 30 frames/days, and then slowly fades to gray over the span of the entire war."Accompanying the visual representation is a soft 'tic' sound for each fatality, the volume of which increases relative to the number of fatalities that occurred simultaneously that day. More deaths in a smaller area produce visually deeper reds and audibly more pronounced 'tics.'"

Friday, July 08, 2005

London Bombings - Comments from Map List Posting

This was taken from a MapInfo-L list I found relevant.

"It was aimed at ordinary, working-class Londoners, black and white, Muslim and Christian, Hindu and Jew, young and old. It was an indiscriminate attempt to slaughter, irrespective of any considerations for age, for class, for religion, or whatever.

That isn't an ideology, it isn't even a perverted faith - it is just an indiscriminate attempt at mass murder and we know what the objective is.

They seek to divide Londoners. They seek to turn Londoners against each other."

I will admit to being very scared yesterday, when the mobile phone networks went down and I couldn't get hold of any of my friends or family. Or when they started to clear the building I work in because they thought there was a car bomb in the car park next door. But I refuse to let it ruin my life or to let it change the way I view people.

If we give into fear and racism - looking at people differently because of the colour of their skin or who they are then the f****** will have won.

Don't give them that victory.

"It was aimed at ordinary, working-class Londoners, black and white, Muslim and Christian, Hindu and Jew, young and old. It was an indiscriminate attempt to slaughter, irrespective of any considerations for age, for class, for religion, or whatever.

That isn't an ideology, it isn't even a perverted faith - it is just an indiscriminate attempt at mass murder and we know what the objective is.

They seek to divide Londoners. They seek to turn Londoners against each other."

I will admit to being very scared yesterday, when the mobile phone networks went down and I couldn't get hold of any of my friends or family. Or when they started to clear the building I work in because they thought there was a car bomb in the car park next door. But I refuse to let it ruin my life or to let it change the way I view people.

If we give into fear and racism - looking at people differently because of the colour of their skin or who they are then the f****** will have won.

Don't give them that victory.

Subscribe to:

Posts (Atom)